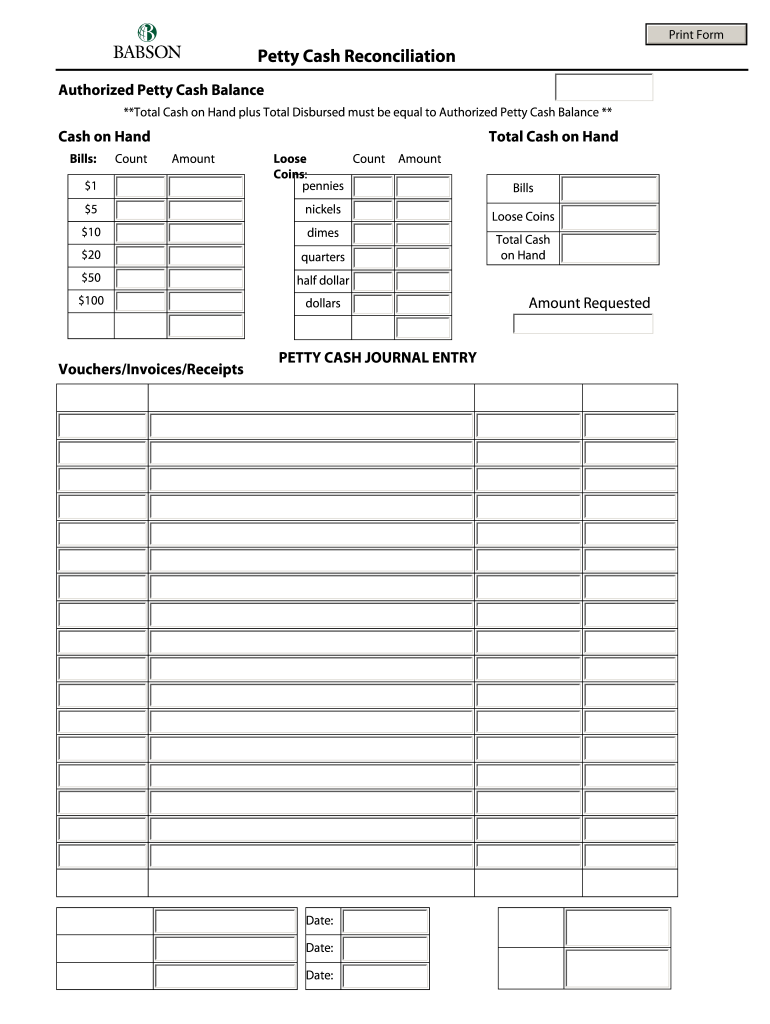

Get the free petty cash reconciliation form

Get, Create, Make and Sign

Editing petty cash reconciliation form online

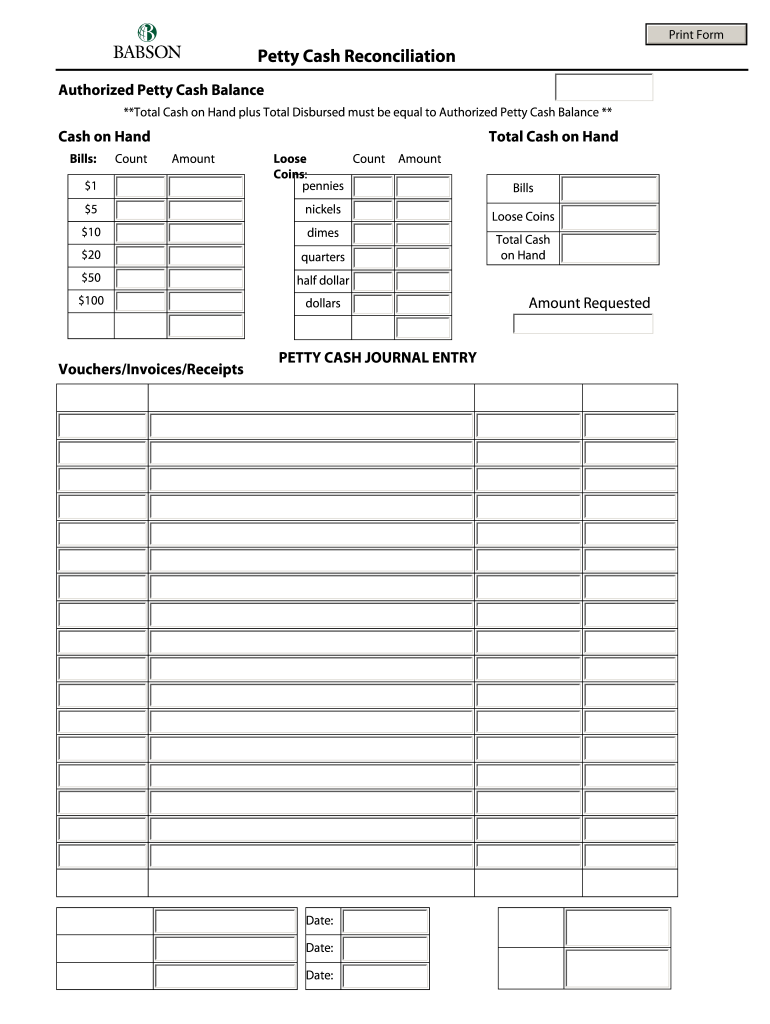

How to fill out petty cash reconciliation form

How to fill out form forms:

Who needs form forms:

Video instructions and help with filling out and completing petty cash reconciliation form

Instructions and Help about daily cash reconciliation template form

Welcome to this video this is the bookkeeper master on YouTube and this is the first video of a very short series of videos that will show you how to create a very simple basic petty cash spreadsheet using Microsoft Excel or a similar package I'll go through the template very quickly with you, and then I'll show you how to create it by going through it step-by-step tutorial we have our opening balance of our petty cash account there's space for the date of each petty cash transaction a voucher number for those of you who are new to petty cash you should complete a petty cash voucher every time there is an expense you'd write the description on the voucher and the amount and then the receipts would be stapled or attached somehow to the voucher and then that's use later on for auditing purposes or simply just to fill out this spreadsheet with accuracy we have space for money in with monies paid in to petty cash this is generally paid in through draw money out of the bank, but you could change money into sales if your petty cash, and he ever receives money through cash sales, and then I have a number of expense codes from my experience petty cash is generally used for refreshments like buy milk for seeing coffee postage stationery cleaning products, and then I have another column at the end obviously you can change these headings to fit your business as each expense goes out there is a total for the expense the reason there's a total at the end is from my experience generally when people will spend petty cash and get a receipt they may have bought a few items in one shop some of them may be refreshments and there may be stationary, so you can break down the receipt into the correct expense categories and then have your total at the end each category is totaled at the bottom if you're entering this information into accounting software it's handy to have the totals at the bottom as this is what you would enter into your sage or cash flow QuickBooks etc we then have total money in or a — — or a total sales if money is added to petty cash because of sales and a closing balance for our petty cash account we have a number of tabs down the bottom one for each month of the year and all we simply do is copy the template post it the next month and fill it in, and it's as simple as that so let me show you how to create this petty cash template simply click on the link to the right for the first video in the tutorial

Fill petty reconciliation form printable : Try Risk Free

People Also Ask about petty cash reconciliation form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your petty cash reconciliation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.